Please sign in or create an account to download the full report.

In recent years, the policy environment for small and medium-sized enterprises (SMEs) in the People’s Republic of China has undergone a significant transformation. Every year, the EU SME Centre’s Advocacy Platform sets out to provide with the Policy Environment Report an overview of the most significant developments affecting SMEs operating in the country.

SMEs constitute an overwhelming majority of the enterprises in China and are key to its economic development. Around 50 per cent of the nation’s tax revenue and 60 per cent of China’s gross domestic product (GDP) come from SMEs. Small businesses are also major contributors to employment and innovation. In 2022, the total number of micro, small and medium-sized enterprises in China exceeded 52 million, with specialised SMEs accounting for 59 per cent of enterprises that went public (in terms of the capital market).

As in China, SMEs are the backbone of the European Union’s economy. In 2024, there were around 26.1 million SMEs in the non-financial sector active in the European Union (EU), representing 99.8 per cent of all enterprises in the non-financial business sector. These SMEs accounted for 63.1 per cent of employment and slightly more than half of the value added in the EU.

Understanding the different approaches to determining what constitutes an SME in the EU and China is important when analysing their respective ecosystems, as some companies considered SMEs in China would not have this denomination in Europe due to their larger size in terms of employees and/or annual turnover.

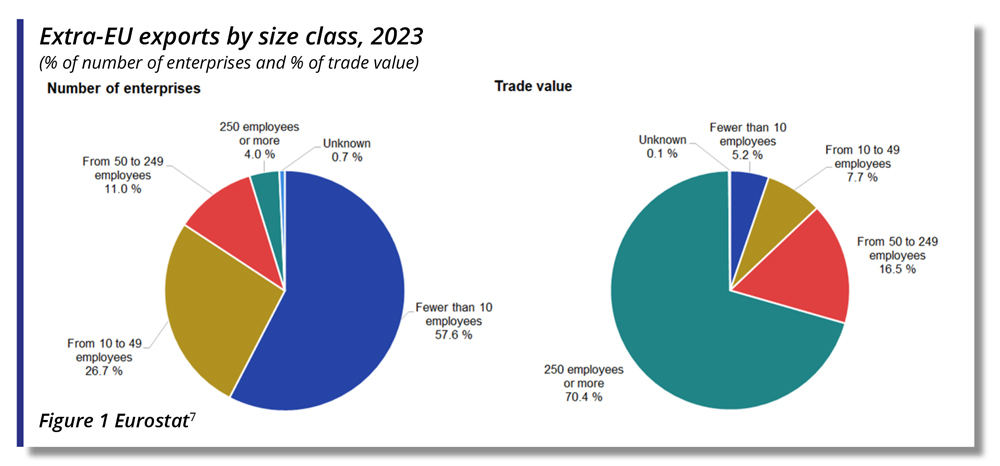

When it comes to international trade, the European Commission estimates that, as of 2023, micro, small and medium-sized enterprises represented 95.3 per cent of exporting enterprises for extra-EU exports and accounted for 29.4 per cent of the value of extra-EU exports.

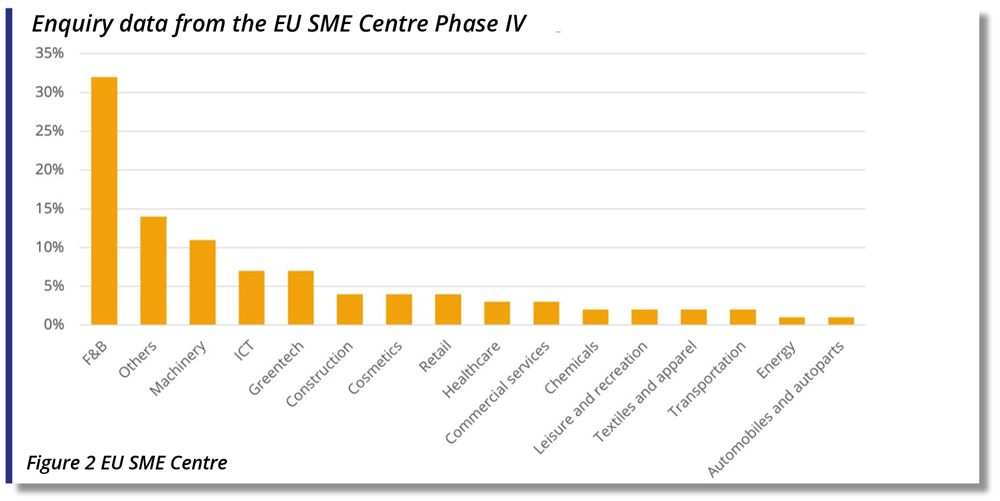

Enquiry data from the EU SME Centre Phase IV (from July 2022 to late June 2025) shows a predominance of interest in the Chinese market coming from businesses in the food and beverage, machinery, information technology and green technology industries. The top six countries of origin for SME enquiries were Italy, Belgium, Poland, France, Germany, and Denmark.

Following the end of its zero-COVID policy, China’s economy entered a cautious recovery phase in 2024, with GDP growth at five per cent according to Chinese government figures. Domestic demand remained subdued, with the growth contribution of final consumption declining to 1.3 percentage points in Q3 2024 and the consumer price index growing only by 0.2 per cent year-on-year. Consumer confidence growth also underperformed throughout 2024.

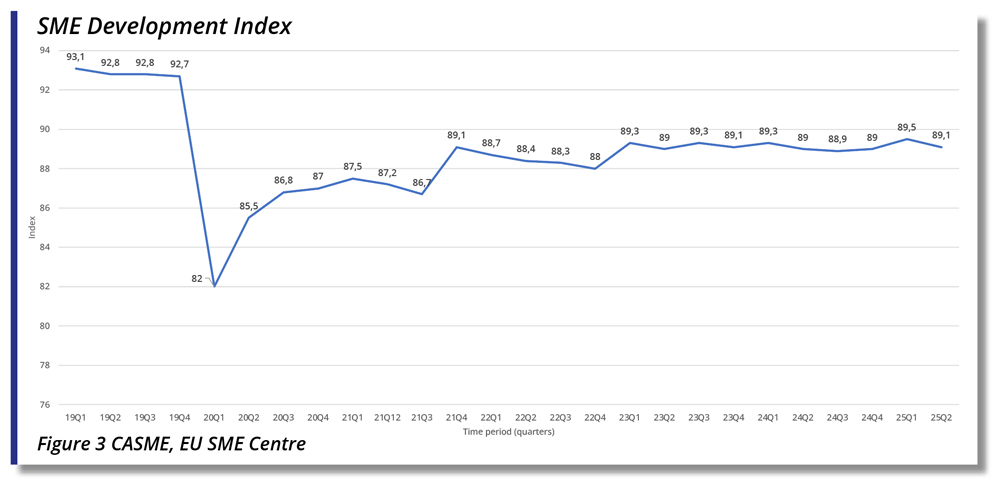

The slowdown in China’s economic growth has been reflected in key SME performance indicators, including the SME Development Index published by the China Association for SMEs (CASME). While the index has shown a gradual recovery following the end of zero-COVID restrictions, the pace of improvement has been limited. Throughout 2024, the index remained largely stable with minor fluctuations, yet it continues to lag behind pre-pandemic numbers.

These developments have created a more challenging environment for European businesses operating in China. According to the European Union Chamber of Commerce in China’s Business Confidence Survey 2025 (BSC 2025), a record 73 per cent of surveyed companies reported that doing business in China has become more difficult.

When asked about their top three challenges for future operations, 71 per cent of respondents cited China’s economic slowdown, followed by the escalating US-China tensions and broader geopolitical risks. In addition, only 38 per cent of respondents reported revenue growth in 2024, the lowest share on record.

In response to persistent macroeconomic pressures and subdued economic growth, the Chinese government has intensified efforts to bolster the private sector, particularly SMEs and foreign investors.

The Policy Environment Report offers a comprehensive overview of the current landscape for SMEs in China, covering key areas including financing, administrative procedures, market development, innovation, digital transformation, and green development.

1. Introduction to SMEs in China

1.1. Definition and classification of SMEs in China

1.2. European definition and classification of SMEs

1.3. European SMEs and China – data from the EU SME Centre

2. Analysis of the current policy environment of SMEs in China

2.1. Financing and reduction of financial burden

2.1.1. Financing

2.1.2. Reduction of financial burden

2.2. Administrative procedures and services

2.3. SME market development

2.3.1. Talent acquisition and retention

2.3.2. Competition and procurement

2.4. Protection of the rights of SMEs and supervision mechanisms

2.4.1 Intellectual Property

2.5 Innovation and Entrepreneurship

2.6. Digital transformation of SMEs

2.7. SME green development

3. Conclusion