We answer the most common questions foreign-invested enterprises have regarding the registered capital in China.

This is the first of a set of articles on legal and tax-related aspects for operating a business in China, mainly through a legal entity in the country. This article was written by Integra Group, an established provider of company secretarial, accounting, tax, HR, and financial advisory services in China.

The contents are within the sole responsibility of the author and do not necessarily reflect the views of the EU SME Centre or the EU.

UPDATE – 1 July 2024: Entry into Force of New Provisions on Companies’ Registered Capital

In order to strengthen the registered capital management system, regulate shareholders’ capital contribution obligations, maintain market transaction security, and optimise the business environment, new provisions of the Company Law have entered into force on 1 July 2024. In accordance with the 2023 Company Law, shareholders of a Limited Liability Company (LLC) must pay their subscribed capital in full within five years of the company’s establishment. A transitional period will permit companies registered and established before 30 June 2024 with a subscribed capital payment term exceeding 5 years to adjust their remaining contribution period to within 5 years before 30 June 2027. Read the full text in Chinese >

China has a unique system for determining the registered capital requirements for businesses. Although there are no mandatory minimum registered capital requirements specified for all intents business purposes, some specific industries maintain a minimum registered capital requirement in China. It is important to note that while a minimum may not be required by law, businesses may choose to settle upon a higher registered capital to ensure that they have sufficient funds to maintain the day-to-day activities of the company.

Registered capital can be thought of as subscribed capital that shareholders pledge to inject into the company. Unless a minimum registered capital is specifically stated by laws and regulations, investors can determine a registered capital based on the needs of the business and provide said capital according to their cash requirements. The period to top-up the registered capital is normally written in the company’s articles of association.

Ultimately, the registered capital’s purpose is to provide investors with the means to supply the necessary funds for the business to operate and fulfil its obligations. Thus, it is important to consider the business requirements when deciding on the amount of capital required at the setup stage of the company.

The registered capital is the primary funding used to cover the costs of establishing and operating the business until it can sustain itself.

One important factor to consider is the type of business that the company will engage in; different business types may require different investment amounts. For example, a manufacturing company may require a larger amount of capital than a service-based business because it will need to purchase equipment and materials. It is also important to consider the potential growth of the business and the amount of capital that will be needed to support this growth.

As a general rule of thumb, we recommend budgeting for a minimum of 6 months of operating expenses as registered capital, assuming that the company can become self-sustaining after six months.

Normal operating expenses and capital expenditure during the initial stage include:

In the case where certain industries require, by law, to maintain a minimum registered capital, these requirements are in place to ensure that businesses have sufficient funds to operate and fulfil their obligations. These generally include industries with numerous stakeholders across supply chains or with important roles in society and the economy.

Business owners or their representative agents tasked with incorporating the entity should review each business scope item individually and identify whether a minimum registered capital is required to register said item.

Additionally, the size and structure of the company can have an impact on the registered capital requirement. For example, a business with operations at the provincial or state level may register their company name with the words “Province” or “China”. As this type of company has businesses spanning different cities and provinces, the minimum capital requirement set by the Administration for Market Regulation will be higher. In addition, specific industries like labour dispatching or headhunting service companies must meet certain minimum capital requirements and certifications before being able to carry out business operations.

For instance:

XYZ Group Textile Manufacturing (Jiangsu) Co. Ltd.

or

XYZ Group Textile Manufacturing (China) Co. Ltd.

Normally, there are two methods that investors can use to contribute capital. These methods are cash contribution and contribution in kind.

Cash contribution is the most common method of contributing capital in China. With this method, the company’s investors provide the required capital in the form of cash paid to a special capital account belonging to the company. This capital can then be used freely to cover business expenses such as purchasing products, paying staff, rental expenses, and advertising.

Notably, the monetary capital contribution of all shareholders shall not be less than 30% of the registered capital of the limited liability company.

Contribution in kind refers to the company’s investors providing assets or property to the business in lieu of cash. These assets or property are then used by the business in its operations and/or to generate revenue.

To provide in-kind capital contributions in China, the company must determine the fair value of the property, goods, or other assets being contributed by the shareholder. This is typically done by a professional appraiser or using other methods such as market value, cost value, or net asset value. The value of the capital contribution in kind must also be recorded in the company’s Articles of Association and the shareholder must provide proof of ownership.

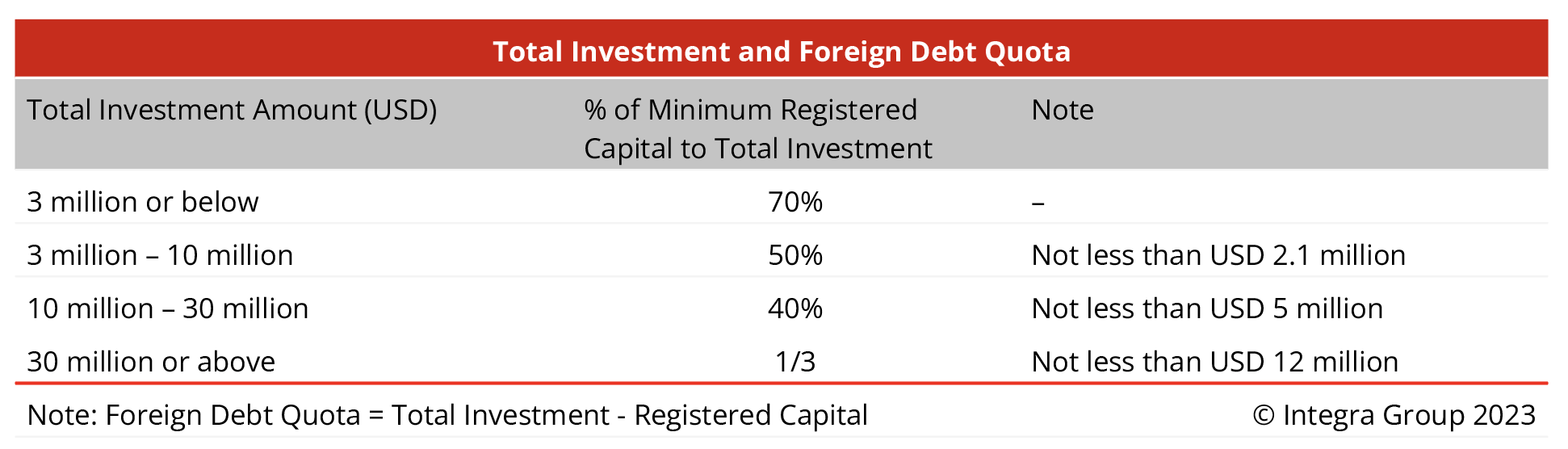

In China, companies are permitted to register foreign loans in addition to the registered capital up to a prescribed limit known as the ‘foreign debt quota’. In order to register a foreign loan, the company should state a total investment that is greater than the registered capital on the article of association. The difference between the total investment and the registered capital is the amount to be registered as a foreign loan.

Total Investment = Registered Capital + Foreign Loan

The foreign debt quota for companies in China is interlinked with the registered capital amount. In other words, the debt-to-equity ratio for foreign invested enterprises in China is limited by law. As the amount of registered capital increases, so does the debt-to-equity ratio according to the following table:

Additionally, enterprises can choose to apply the Macro-Prudential Method for calculating the upper limit of the amount of foreign debt they are permitted to register (Yingfa [2017] No. 9). The Macro-Prudential Method may allow the enterprise to register a foreign loan greater than what is permitted under the standard Foreign Debt Quota.

The foreign debt calculated using the Macro-Prudential Method must be submitted to the SAFE for approval.

Foreign debt limit = (Assets & Net Assets) x (Financing Leverage Ratio)

x (Macroprudential Adjustment Parameters)

Should the investor(s) of a company in China decide they would like to decrease their investment in China, they are able to do so. The company can return part of the capital investment to the shareholders and decrease the registered capital.

To decrease the registered capital of a business in China, the company must submit a request to the Administration for Market Regulation (AMR). This involves completing and submitting a registered capital decrease application together with supporting documents including the shareholder resolution, a balance sheet and a list of assets, and other relevant materials. The AMR will review the request and, if approved, issue a certificate of registered capital reduction and updated business license. The company must then complete the additional steps required, such as making changes to its articles of association and updating the business license with the bank and other institutions.

In China, shareholders are typically liable for their registered capital in a company limited by shares, up to the amount of their registered capital contribution. This means that the shareholders are personally responsible for the amount of capital they have agreed to contribute towards the company’s registered capital, and they may be required to pay this amount if the company is unable to fulfil its obligations. However, the liability of shareholders for their registered capital in China is not without limitation and may vary depending on the specific circumstances of the company.

The statutory reserve fund refers to the mandatory fund which companies must pay into when distributing dividends. When the company pays a dividend, it must set aside 10% of the total amount into a statutory reserve up to an amount equal to 50% of the registered capital.

The statutory reserve can be freely injected back into the company at any time by means of increasing the registered capital. The statutory reserve fund is mandated by law as a “rainy day” fund for companies in China.

Author: Integra Group

Integra Group is a fully licensed Asia-focused accounting, taxation, and business advisory firm – with dedicated offices in Shanghai, Beijing, Singapore and Taipei. We’ve helped companies ranging from Fortune 500 companies to small to medium sized businesses to establish and grow their presence in Asia.

Find out more on Integra Group’s website.

Contact Integra Group.