China is one of the world’s largest dairy markets and certainly the largest importer of dairy products. Although a series of demand and price disruptions impacted the market in 2022, experts expect China’s dairy sector to stabilise in 2023 and return to growth in the following years. A key driver of the market is the increased health awareness of Chinese consumers.

This offers opportunities to European dairy producers, although the competition from other traditional dairy exporters regions is fierce. Furthermore, the image of domestic dairy products has gradually recovered after undergoing various incidents and scandals that occurred in the past. At the same time, EU dairy producers will need to navigate through a series of complex technical requirements – and barriers – in order to be allowed to export to China.

Our new report aims to guide EU dairy producers through the process, while highlighting elements that can be leveraged on.

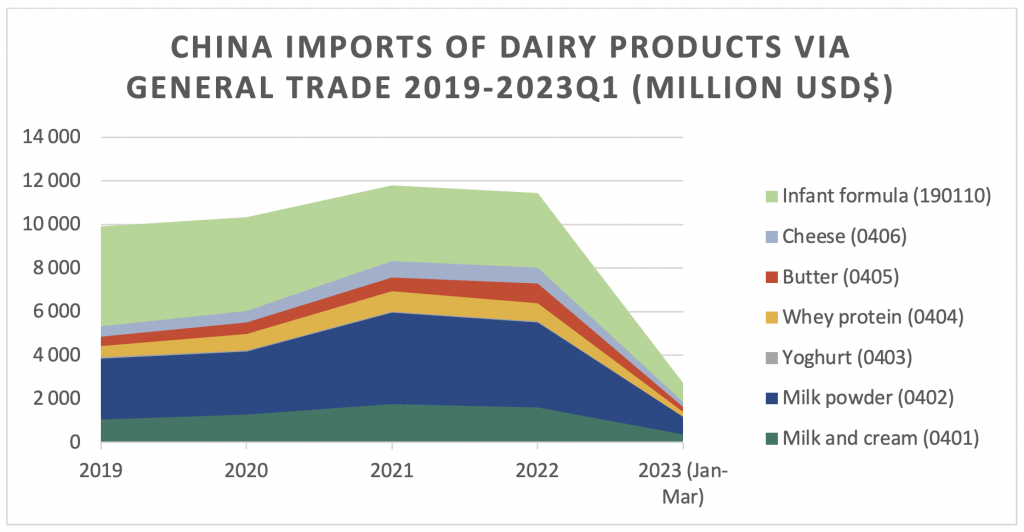

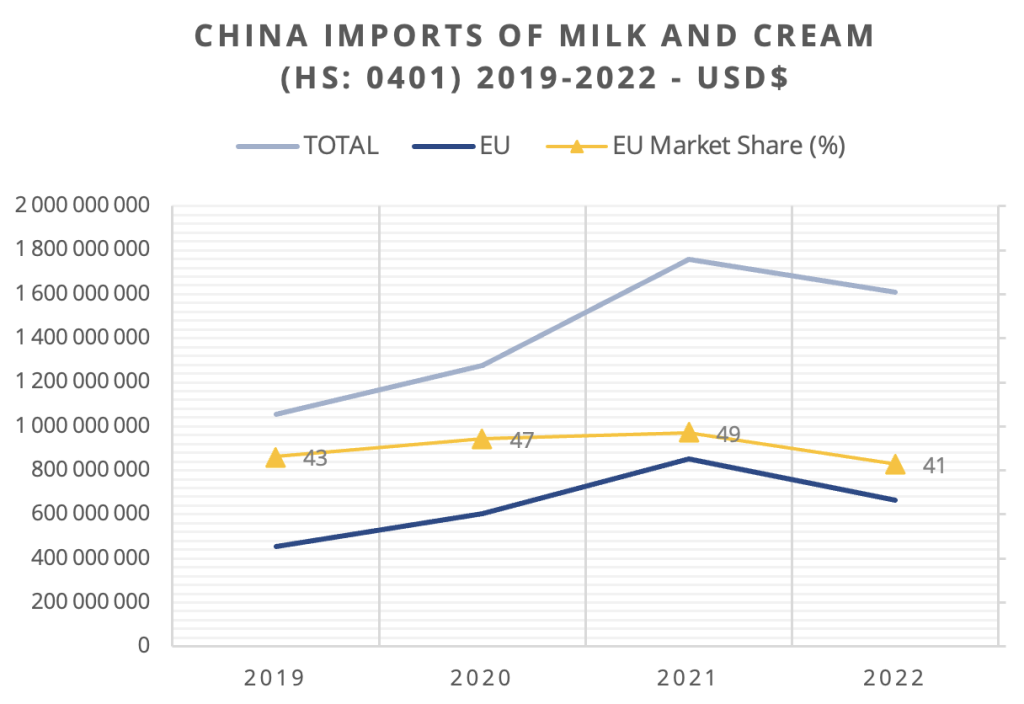

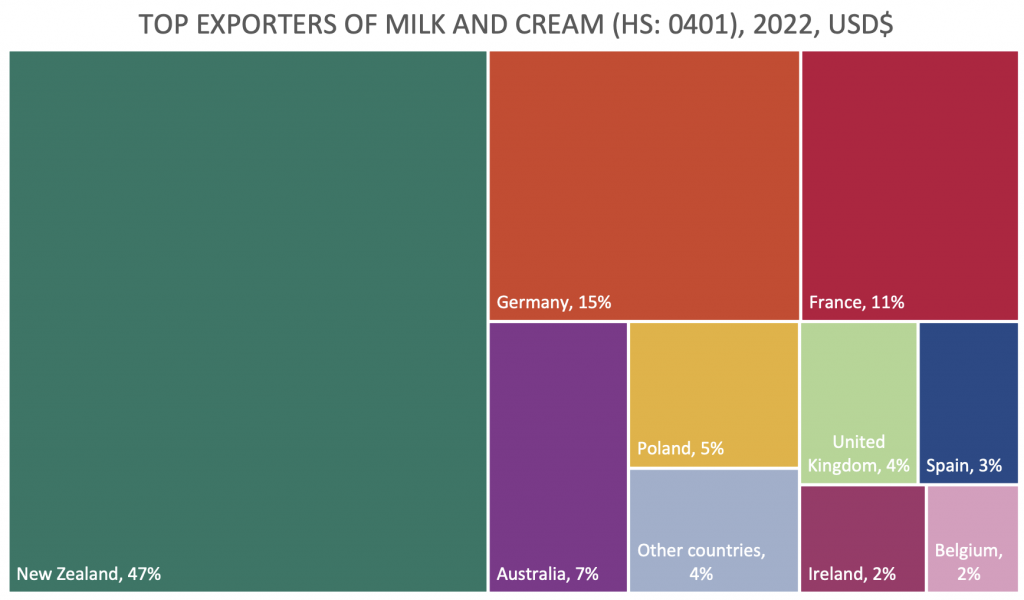

The first chapter provides an overview of the Chinese dairy market. It highlights how Chinese people’s increased health awareness and the initiatives of Chinese authorities are driving the development of the market, and in particular domestic production. We provide a detailed analysis of dairy imports into China for various dairy segments, with EU dairy products leading in some categories but lagging behind in others. We also present the most popular retail channels available in China.

The second chapter provides a detailed overview of the regulatory and technical requirements for importing dairy products into China. It focuses on issues such as country protocols and eligibility, GACC/CIFER registration for production establishments, as well as heightened requirements for infant formula. You will find in this chapter details on food safety standards as well as labelling standards. The last section of this chapter provides an analysis of rejected imports by customs and the main reasons for rejection in the last year.

The third chapter summarises a series of tips and recommendations for European dairy exporters approaching the Chinese market. It also includes some of the unique elements that EU producers can leverage. We list the dairy products protected under the EU-China Geographical Indication Agreement, as well as the funding opportunities at the EU level. In this chapter, we also go into considerations on intellectual property protection.

Finally, the last chapter illustrates the key findings from interviews conducted with 8 dairy industry professionals in China. This section includes insights from local importers, distributors, producers, as well as retailers.

On 10 July 2023, SAMR released the revised Administrative Measures of Product Formulation Registration of Infant Formula Milk Powder, which will enter into force on 1 October 2023. Compared to the previous version illustrated in the EU SME Centre report, these revised guidelines will:

Click here to access the revised measures in Chinese on SAMR’s website.

The Cream of the Crop: Exporting Dairy to China

Watch this webinar to get tips on exporting dairy to China, marketing, consumer tastes, and other aspects of the sector. Understand how to register with the General Administration of Customs of the People’s Republic of China (GACC) and how to prolong or renew your certification. This event also features a presentation on trademark registration before entering the Chinese market and other aspects of IPR protection.